Beyond Shareholder Primacy, One Clause at a Time: A Primer on Stakeholder Governance

To achieve B Corp Certification, all companies, regardless of their industry or size, are required to amend their governance structure to legally hold themselves up to the commitment they have made: to benefit all the stakeholders that they impact with their activities – beyond just their shareholders.

On the occasion of B Corp Month in March, the world celebrates the many ways Certified B Corporations go beyond business as usual. In this article, we provide an overview of what stakeholder governance is, why this concept is so closely knit within the B Corp movement’s global vision of a regenerative, equitable, and inclusive economic system, and how companies that make it their own go beyond the status quo.

Shifting the Paradigm

Since its very inception in 2006, B Lab, the non-profit, global network organization behind the B Corp movement and certification, set quite an ambitious goal for itself: To change the rules of the game for the global economic system. This vision stems from the fundamental recognition that the paradigm that informs the way how business is done has acted as a key driver for multiple social and environmental disruptions over the past century.

The way this paradigm evolved and locked into place inevitably ended up shaping the social expectations around the role of business in society. More concerned with prioritizing profits over the common good, companies in this system developed ways of thinking and operating that incrementally pushed earth’s system towards a number of limits. More traditional and profit-driven companies adopted extractive models, both towards the communities surrounding the company and its value chain, as well as the ecosystems they depended on. As they ground into gear, these “rules of the game” eventually doomed these companies to embrace short-termism. More often than not, companies in this paradigm went about their business, disregarding the complex and delicate feedback loops that regulate the long-term behaviors of socio-ecological systems.

It goes without saying that pockets of for-profit companies did exist in this paradigm who did not only see themselves as merely dividend-generating entities but also as positive societal and environmental stewards. Still, it was not uncommon to witness them eventually swept by the rules of the Market (for example, by having their purpose watered down or put aside as a consequence of dynamics such as ownership changes or market growth).

The recognition of this dynamic triggered a wild idea: What if a new type of company existed that was provided with the tools not only to protect its purpose but to go as far as carving it down to the very bone of its legal DNA?

Locking the Mission

The term Stakeholder Governance defines an economic model where companies anchor the commitment to preserve their mission over time into their legal DNA. In this new paradigm, companies wire their foundational structure to a social and/or environmental purpose.

In the context of the B Corp movement’s vision and mission, the stakeholder governance paradigm is a desired new regulatory and cultural state for the economic system. In this system, companies finally leap beyond shareholder primacy, holding themselves legally accountable to all those who either contribute to or are affected by the business and therefore have a “stake” in it.

The active implementation of stakeholder governance principles became a cornerstone of the B Corp movement since its inception. Unsurprisingly, one of the primary eligibility requirements for any company aspiring to become a certified B Corp is to incorporate stakeholder governance into its legal object and, in doing so, “lock their mission”.

As the B Corp movement grew across Europe, different frameworks and pathways toward stakeholder governance arose for companies.

- In several European jurisdictions, companies comply with the above-mentioned requirement by adopting a special legal entity that empowers companies to protect their mission over time. First deployed in the US, a Benefit Corporation is a legally approved business entity that enables the company to adopt it to create solid foundations for long-term mission alignment and value creation.

- Advocating for “Benefit Corporation-like” corporate structures to be recognized across nations is a key endeavor B Lab undertook along the stride of the B Corp movement in Europe. Policy changes that would transform the way businesses operate were implemented in Italy in 2016, with the creation of the Società Benefit legal entity, and subsequently in France, when the entity Entreprise à Mission came into existence in 2019.

- At the time of writing, other countries are on the way to pursuing the same outcome. While such a legal framework does not exist in Switzerland yet, the Swiss government’s Public Procurement Act sets obligatory sustainability criteria for all of its 27 states.

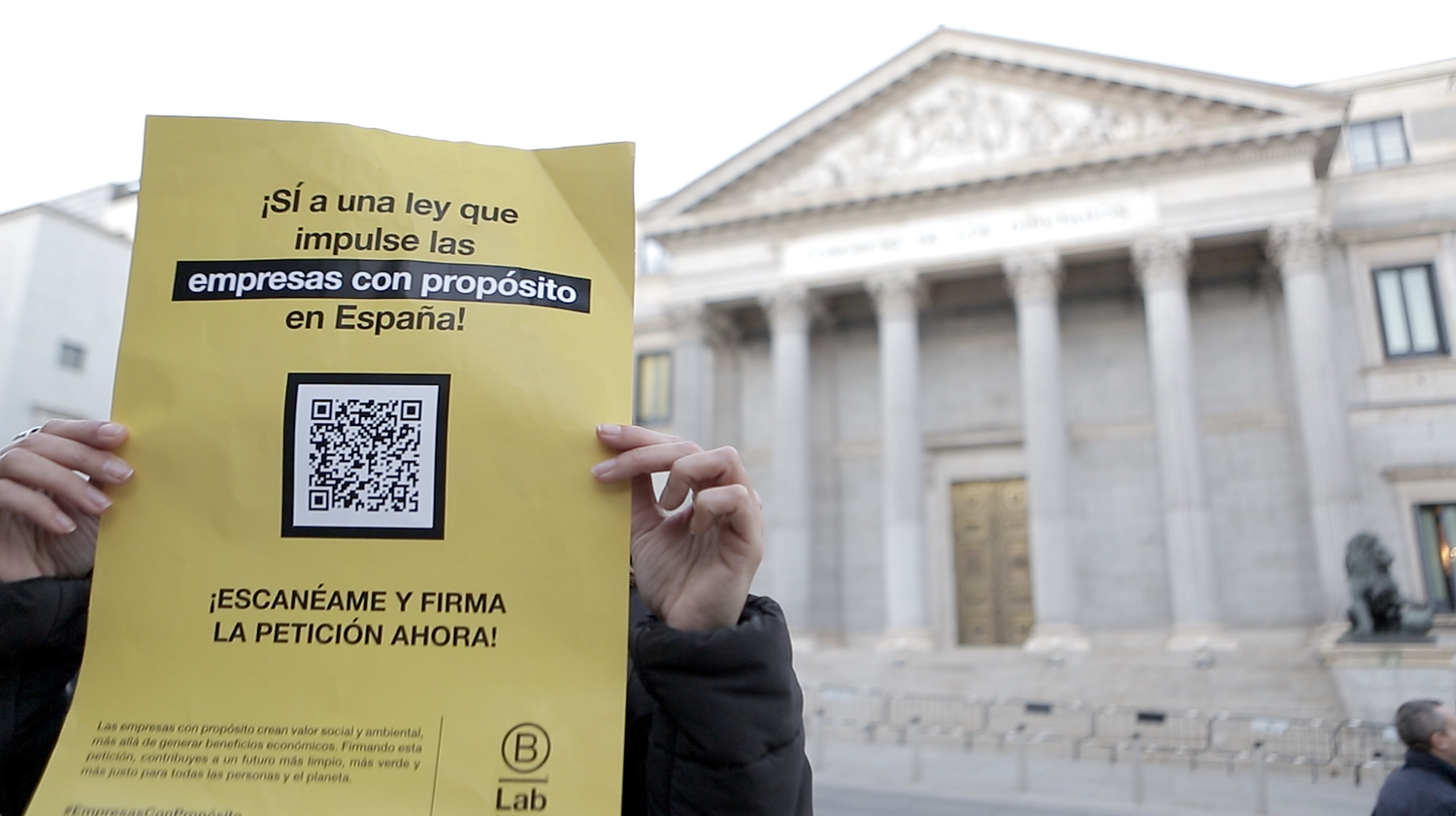

- In 2022, B Lab Spain, supported by the activist companies composing the Spanish B Corp community, coordinated the Empresas Con Propósito (translating to companies with purpose) initiative to request their legal recognition as Benefit and Common Interest Companies. This resulted in a political agreement reached in the Spanish Parliament for the creation of the legal figure Common Benefit and Interest Societies (SBIC). The SBIC entity will recognize the companies that generate social and environmental benefits in addition to an economic return.

As work is being done to create more momentum for these new forms of legal frameworks, other countries that did not get as far as Italy, France, or Spain have a different requirement: to include clauses in their constitutions/articles of association that determine the purpose/object, and the responsibilities of directors towards all stakeholders.

The Spanish Congress of Deputies approved the legal concept of Empresas Con Propósito in June 2022.

B Corps as a Global Proof of Concept of Stakeholder Governance

The latest Edelman Trust Barometer reports an overall unbalance when it comes to trust in institutions: strikingly, governments appear as less trusted than businesses in most countries (Edelman 2023). As such trends emerge in the broader context of an increasingly polarized society, companies have a moral obligation to step up and prove themselves beyond the traditional societal expectations around business.

The adoption of stakeholder governance principles as a blueprint for a company’s culture is a step that makes Certified B Corporations substantially different from traditional for-profit companies. In essence, this shift empowers these businesses to fundamentally reframe the definition of success: from the classic liberalist view of profit as an end to a mindset that sees it as an instrument to achieve positive social and environmental impact. Going to this length allows B Corps around the world to undertake the same essential endeavor, regardless of their size, or the industry they belong to – that is, bringing ethics back to the foundation of corporate governance.

Accountability

As increasingly informed consumers settle into their role as activists, an ever-so-sharp public eye is firmly set on the business world. A growing part of society acknowledges the potential for the for-profit world to effectively contribute to transitions towards more equitable and regenerative systems. At the same time, the general public is becoming savvier with the different ways greenwashing has to find its way through business practices and narratives.

The societal expectation from business has changed: companies have a duty and responsibility to care and will be held accountable. In this scenario, businesses that make stakeholder governance their own consciously opt into a higher level of accountability, together with the related risks. Whether they adopt a Benefit Corporation-like legal form or amend their articles of association, by complying with this requirement, all certified B Corps take a step that has legal significance. The mission is embedded in the legal object of all B Corps, and living up to it is part of the responsibilities of its directors. For these reasons, certified B Corps make it harder for themselves not to walk their talk: these statutory provisions are, in fact, relevant in matters of liability (BvDv 2020).

Impact and Risk Management

All certified B Corps have seen their efforts held to high standards and validated across several impact areas in the B Impact Assessment: Governance, Workers, Environment, Community, and Customers. Each of these sections represents a key stakeholder that any business has a direct or indirect impact on through its operations and business model. This all-encompassing approach to impact assessment encourages the adoption of holistic thinking as a guiding principle for the company’s way of carrying out the business. This makes it easier for companies that adopt a way of doing business to set the foundation for consistent, coherent, and sustainable stakeholder and impact management. By challenging themselves to keep all these dimensions in check, companies daring to adopt a stakeholders-first decision-making blueprint end up increasing their own resilience in the process.

In the words of Olav Fromm, Managing Director at the Certified B Corp Chiesi Nordic, by committing to be accountable towards multiple stakeholders, companies can get “extremely good insights that are also good for the business”, ultimately bringing about a “win-win situation”.

This approach positions companies ahead of the risk management learning curve. Especially in Europe, looking at the state of affairs in the broader regulatory picture of the European Green Deal (such as the upcoming, much-talked-about CSRD that European companies are preparing for).

Talent and Culture

An increasing percentage of people (69%) expect their employer to have an impact beyond profit when considering a job (Edelman Trust Barometer, 2023). Through the products they buy and the social and environmental causes they make their own, younger generations are already dictating the business agenda. This translates into their expectations around the purpose of their profession and the company they work for. As this generation of new candidates more vocal about climate change and social justice enters the workforce, when given the opportunity, they will be more selective towards jobs that align with their values (Gulf News 2023). It will become increasingly less costly for employees to leave companies that do not match their values – and, in turn, companies will need to put in the work in order to retain them.

At B Lab, we can see this trend reflected in our own B Corp community: the talent acquisition team of London-based B Corp Kin+Carta, for example, reported in 2022 that the top reason new employees say they chose to work there is because of the company’s efforts in the social responsibility space, and that the B Corp Certification was an influential factor in the decision. Besides, recent internal research conducted by B Lab Europe attests that just in the EU, B Corps saw 22% annual growth on average and increased interest from high-quality applicants, followed by high levels of staff motivation and retention. The shift to stakeholder governance requires companies to take ownership of their positive and negative impact, and more so, as their own workforce takes the role of first watchdog. As the CEO of French Certified B Corp Chloé, Riccardo Bellini tells, adopting stakeholder governance as the primary governance principle “requires a fundamental, long-term shift in the culture of the organization”. Eventually, this “social pact” between employee and employer manifests itself through lower levels of turnover, and structures of mutual accountability that permeate the culture of the organization from within.

Collective Action and Advocacy

Business has traditionally taken a driving role in shaping public policy priorities. In this sense, the increasing interest and action from the private sector towards sustainability matters can be used by governments as a vote of confidence to advance ambitious policies that, in turn, provide companies with the clarity and confidence they need to unlock further investments.

Triggering this mutually reinforcing feedback loop is an objective that B Lab Europe is making its North Star. As more and more B Corps join the ranks, the Interdependence Coalition (IC) was founded in 2021 to gather and channel the instance of all those companies who believe that every company registered in the European Union must act with a duty of care towards all stakeholders. With now, more than 400 companies from around the EU as supporters – not only have these companies adhered to the stakeholder governance blueprint required by the B Corp Certification process, but they are advocating to bring the struggle higher up directly to the policy control rooms in Brussels and Strasbourg.

The Interdependence Coalition is now advocating to save Article 25 of the EU Corporate Due Diligence Directive (CSDDD). This one game-changing represents a unique and urgent opportunity to change how directors of companies should think about sustainability matters and how they embed them in the operations of the company, looking beyond profits to run their business in a way that benefits all stakeholders.

You can sign the petition here and find out more about it in the latest webinar.

The Interdependence Coalition advocating for saving Article 25 of the EU CSDD Director's duty of Care, 2023.

Purpose and Profit

The practice of using organizations as a means for social and environmental regeneration undertook a transformation in the last decades: from an idea conveniently relegated by mainstream businesses to the nonprofit world to one recognized, adopted, and championed by forward-thinking companies the world over. More than 6,500 Certified B Corps around the globe (and over 2,200 across Europe including the UK) have been taking the leap of faith toward stakeholder governance and demonstrating outstanding levels of resilience and impact on the way. The evidence doesn’t merely hint that it is possible to balance purpose and profit – market trends from the B Corp Community tell us that stakeholder duty of care and successful business do go hand in hand.

As the complex and nuanced conversation around the relationship between business and sustainability carries on, for a company to embed stakeholder governance within its legal structure (and by doing so, embracing the related risks) represents an unambiguous step.